All Categories

Featured

Table of Contents

- – The Definitive Guide for Immediate Guidance Fo...

- – Some Known Details About Federal Initiatives f...

- – Some Ideas on Creating a Personalized Debt Re...

- – Getting My What Regulations Says While Receiv...

- – The Basic Principles Of The Pros and Disadva...

- – The Facts About Everything to Know During th...

Applying for credit score card financial debt mercy is not as easy as requesting your balance be eliminated. Financial institutions do not readily use financial obligation mercy, so recognizing exactly how to provide your situation successfully can boost your possibilities.

I wish to go over any alternatives offered for decreasing or settling my debt." Financial debt mercy is not an automatic alternative; in a lot of cases, you need to negotiate with your financial institutions to have a section of your balance minimized. Bank card companies are often open to settlements or partial mercy if they think it is their finest possibility to recuperate a few of the money owed.

The Definitive Guide for Immediate Guidance Following Why Low-Interest Loans Are a Lifeline for Veterans Navigating Civilian Life

If they offer complete forgiveness, obtain the arrangement in writing before you accept. You may require to submit a formal composed request clarifying your challenge and just how much forgiveness you need and supply documentation (see following section). To discuss efficiently, attempt to understand the financial institutions position and use that to provide a strong situation regarding why they should collaborate with you.

Constantly guarantee you receive verification of any kind of forgiveness, negotiation, or challenge strategy in composing. Creditors might offer less alleviation than you need.

The longer you wait, the extra costs and passion accumulate, making it more challenging to certify. Financial debt forgiveness entails legal factors to consider that debtors should know before continuing. Consumer defense laws control just how creditors handle forgiveness and negotiation. The complying with government legislations assist safeguard customers seeking financial debt forgiveness: Restricts harassment and violent financial obligation collection techniques.

Some Known Details About Federal Initiatives for Financial Assistance

Calls for creditors to. Makes sure fair practices in lending and payment settlements. Limitations fees and prevents sudden rates of interest walkings. Calls for clear disclosure of payment terms. Forbids debt settlement companies from billing ahead of time fees. Needs business to reveal success prices and possible dangers. Recognizing these defenses helps prevent scams and unjust financial institution methods.

This time around framework varies by state, normally between 3 and 10 years. When the statute of constraints runs out, they usually can not sue you any longer. Making a repayment or even acknowledging the debt can reactivate this clock. Also if a financial institution "costs off" or creates off a debt, it doesn't imply the financial obligation is forgiven.

Some Ideas on Creating a Personalized Debt Relief Plan You Need To Know

Before consenting to any type of settlement plan, it's an excellent idea to check the law of limitations in your state. Lawful effects of having debt forgivenWhile debt forgiveness can relieve monetary concern, it includes prospective lawful consequences: The internal revenue service deals with forgiven debt over $600 as gross income. Borrowers obtain a 1099-C type and should report the quantity when declaring taxes.

Below are several of the exemptions and exemptions: If you were bankrupt (indicating your complete financial debts were higher than your overall assets) at the time of forgiveness, you may leave out some or all of the terminated financial obligation from your gross income. You will certainly require to complete Kind 982 and connect it to your tax return.

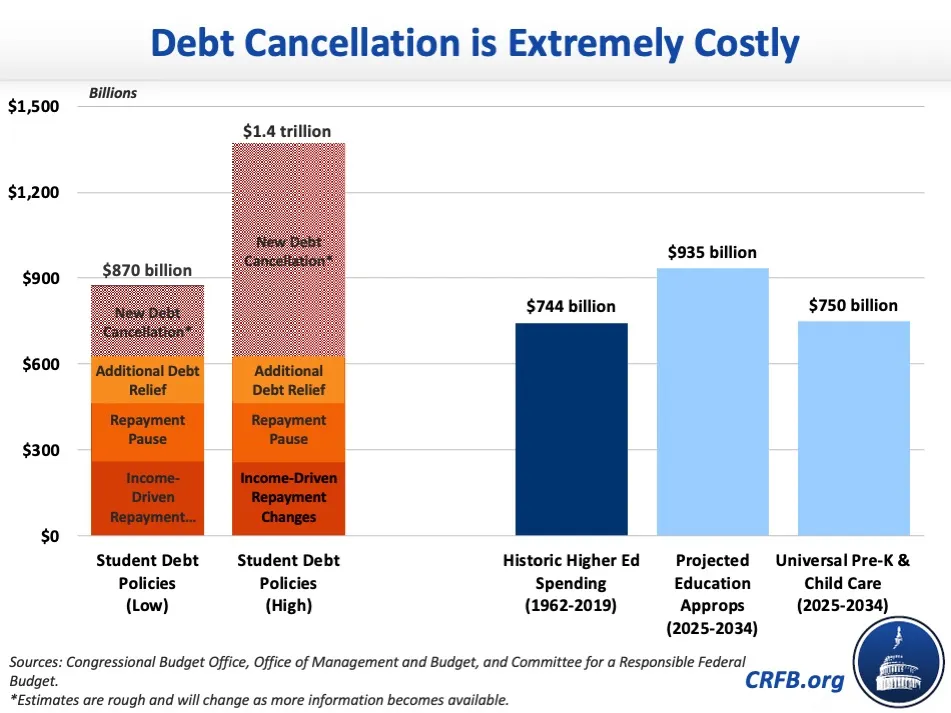

While not connected to bank card, some pupil financing forgiveness programs permit financial obligations to be terminated without tax obligation consequences. If the forgiven financial obligation was related to a qualified farm or organization procedure, there might be tax obligation exemptions. If you don't get approved for debt forgiveness, there are alternative debt relief approaches that might benefit your scenario.

Getting My What Regulations Says While Receiving Bankruptcy Counseling To Work

You obtain a brand-new finance huge sufficient to pay off all your existing charge card balances. If approved, you make use of the brand-new loan to repay your charge card, leaving you with simply one monthly settlement on the debt consolidation finance. This streamlines financial obligation monitoring and can save you money on rate of interest.

Crucially, the firm works out with your financial institutions to reduce your passion prices, significantly reducing your overall debt worry. DMPs might additionally lower or get rid of late fees and charges. They are a great debt service for those with inadequate credit scores. When all various other alternatives fail, personal bankruptcy might be a feasible course to removing overwhelming credit rating card financial debt.

Let's encounter it, after a number of years of higher prices, cash does not go as far as it utilized to. Concerning 67% of Americans state they're living income to income, according to a 2025 PNC Bank research study, which makes it tough to pay down financial debt. That's particularly real if you're carrying a large financial debt equilibrium.

The Basic Principles Of The Pros and Disadvantages When Considering Debt Forgiveness

Combination financings, financial obligation administration plans and settlement techniques are some approaches you can make use of to minimize your financial debt. But if you're experiencing a major monetary difficulty and you have actually tired various other choices, you may have a look at financial debt forgiveness. Financial obligation mercy is when a lender forgives all or a few of your superior balance on a loan or other credit history account to aid eliminate your financial obligation.

Financial obligation mercy is when a lender concurs to wipe out some or all of your account equilibrium. It's a strategy some people use to minimize debts such as credit history cards, individual car loans and pupil car loans. Guaranteed financial obligations like home and auto loan normally do not certify, because the loan provider can recuperate losses by taking the collateral via foreclosure or repossession.

The most popular choice is Public Solution Financing Mercy (PSLF), which cleans out staying federal financing balances after you function complete time for an eligible company and make repayments for 10 years.

The Facts About Everything to Know During the Bankruptcy Journey Revealed

That implies any type of not-for-profit hospital you owe might be able to give you with financial obligation relief. Majority of all U.S. medical facilities provide some kind of medical financial obligation relief, according to person solutions promote team Buck For, not simply not-for-profit ones. These programs, frequently called charity care, decrease or perhaps get rid of clinical costs for competent individuals.

Table of Contents

- – The Definitive Guide for Immediate Guidance Fo...

- – Some Known Details About Federal Initiatives f...

- – Some Ideas on Creating a Personalized Debt Re...

- – Getting My What Regulations Says While Receiv...

- – The Basic Principles Of The Pros and Disadva...

- – The Facts About Everything to Know During th...

Latest Posts

About The Advantages to Consider When Considering How Young Professionals Can Avoid Debt Traps Early in Their Careers

Credentials to Look For from Other The 12 Most Common Myths About Debt Relief—Busted by Real Counselors : APFSC Companies for Beginners

The Definitive Guide to Everything to Know Throughout the Why Low-Interest Loans Are a Lifeline for Veterans Navigating Civilian Life Process

More

Latest Posts

About The Advantages to Consider When Considering How Young Professionals Can Avoid Debt Traps Early in Their Careers